Money is any commodity that has value and is accepted during the exchange of goods and services. We use money as a store of value, a unit of account, and as a medium of exchange. For most of us, money is purely the national currency; Kenya, Uganda and Tanzania Shillings, Rwandan Francs, US Dollars, among others. Did you know that there are alternative currencies that complement the national currency?

Complementary currencies (CCs) are a regional means of exchange that supplement national currencies and enable people to build social solidarity and strengthen local economies. During the lockdown period, actual money was scarce. Businesses had a surplus of products and services to sell, but there wasn’t enough money circulating to keep trade going. CCs were useful in continuing trade activities, enabling the purchase of goods and services through the use of vouchers.

How do CCs Work?

Meet Mike. He’s a shop owner in Mathare. His fully stocked shop is located in a densely populated area, but he struggles to make two sales a day. Mike cannot pay school fees, buy groceries for home use, or pay his bills. While people surround him, none of them has money to purchase the goods he’s selling. To solve his problem, Mike can opt to take a loan to pay his bills or sell his goods at a loss, thus putting him out of business. It’s a choice between a rock and a hard place.

Enter CCs. CCs are a form of local currency created within a community and provide access to credit and liquidity to all members of the network. In addition to trading in the national currency, the network exchanges tokens or vouchers in place of cash. Using this alternative creates liquidity in the sense that the vouchers can be exchanged for money eventually but serve as a means of exchange from business to business, or individual to individual in the network. For success, the network needs to have multiple and varied enterprises to keep money circulating within the community.

Mike can join the CC network in his region as a business that accepts and makes payments in the local CC. The business network includes schools, clinics, transport, individuals, and other SMEs. Upon application, Mike is vetted and given credits that he can use to make payments. These credits are his risk rating, and Mike can not hold CC credits above his risk rating. His risk rating is revalued from time to time and can be higher or lower based on his use of the CC.

Instead of relying on cash to make payments, Mike uses his CC credits at all businesses or organisations that accept CC credits and, because he accepts CC credits he can make more sales. CCs provide mutual credit between businesses and are backed by goods and services in the locality. The purpose of the credits is to enhance circulation and trade and not as a store of value.

Do CCs threaten the national currency?

CC credits work for locally provided goods and services. However, Mike still has to pay Unilever, P&G, Coca Cola, Brookside, Supa Loaf, and other suppliers who do not accept the local CC. How does this work?

Remember, Mike still trades in Kenya Shillings. He can use KES to pay his suppliers, or other businesses outside the CC network or even start saving now that he has extra capital and is making more sales. Alternatively, he can trade the CC credits at a cost for Kenya Shillings.

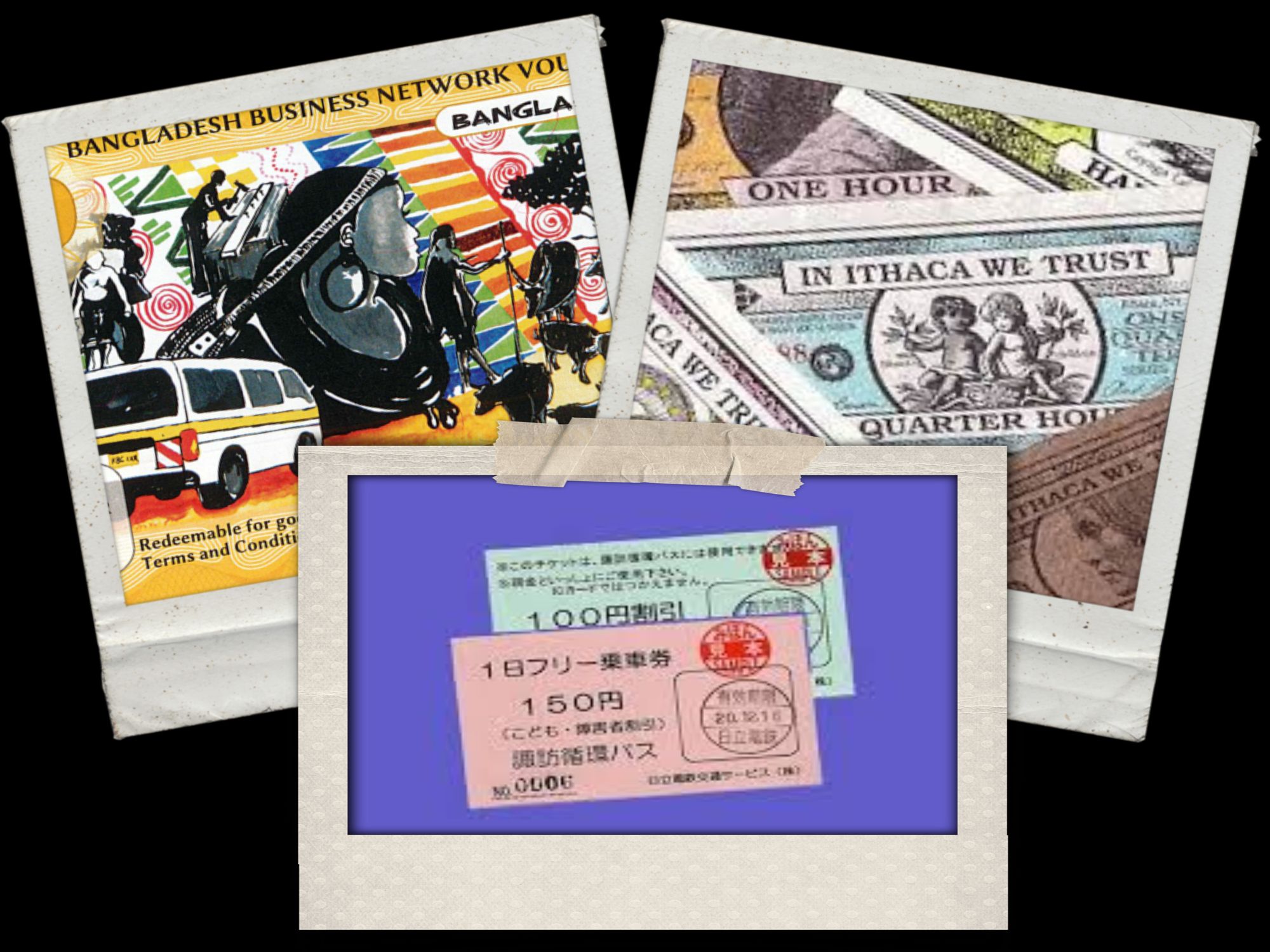

In 2013, the Kenyan State agencies, including the Central Bank of Kenya banned the Bangala-Pesa CC widely used in the Bangladesh Area of Mombasa County. The ban and subsequent arrests of the founders of Bangla-Pesa CC were sparked by fears by the State that the CC would replace the Shilling. After a massive Court battle in 2013 and 2014, the State eventually embraced the CC and appreciated that CCs do not threaten the national currency. Instead, they provide numerous benefits to the community;

- CCs stabilise trade and economy in periods where the national currency is scarce. During the lockdown or other economic downturns, CCs kept businesses going and money flowing within local communities.

- CCs are a zero-rated loan facility as the users are not buying it with national currency but are given vouchers as credits increasing access to cheap affordable credit. The collateral in this model is trust and your social capital.

- CCs help support local businesses. National economies may be doing poorly, but local economies can keep running using CCs.

- CCs help put to use the excess resources of the community that can otherwise not be paid for or quantified. Time-based currencies, for instance, build on the assumption that all humans have valuable talents that can contribute to the wellbeing of society. Using time as a unit, people exchange their time to get benefits in the community. Time-rich but cash-poor people can exchange their time for goods and services.

- CCs enhance participation in community and control over community improvement projects like clean-up projects, waste management projects, security projects, etc. Eco-Pesa in the Kongowea market, for instance, allowed youth to earn credits for every bag of garbage collected from the area. Youth were actively employed and could access goods and services, and Kongowea became a cleaner environment.

Are CCs still active in Kenya?

CCs in Kenya all run under Sarafu-Credit. Sarafu-Credit is a system of community currencies used as a regional means of exchange supplementing the national currency system. Sarafu-Credit has been developed and implemented by the non-profit Grassroots Economics.

Complementary Currencies from Around the World

CCs are not the preserve of developing countries and are used to stimulate local trade around the world. Here are some examples;

- Spice has grown over the last ten years and uses credits to acknowledge people’s contribution to their community. For every hour contributed by a citizen to designing and delivering services, they earn one (1) time credit. With these credits, users can access events, learning, cultural or leisure opportunities, or trade time with neighbours on an hour for hour basis.

- BerkShares are a local currency for the Berkshire region of Massachusetts. The national currency is exchanged for BerkShares at sixteen branch offices of four local banks and spent at more than 400 locally owned participating businesses. The circulation of BerkShares encourages money to remain within the region, building a greater affinity between the local business community and its citizens. BerkShares serve as a tool for community economic empowerment and development toward regional self-reliance.

- The Fureai Kippu (literally ‘ticket for a caring relationship’) refers to a network of mutual support created to provide elderly care. Individuals earn time-credits by providing care to older adults. The credits can then be transferred to relatives or friends in need of care, or be saved for the future when sick or old.

- Ithaca Hours is a local currency used in Ithaca, New York. It is the oldest and largest community currency still operating in the United States. One Ithaca Hour is equal to one hour of basic labour or USD 10.

- Chiemgauer is a local currency started in 2003 in Bavaria, Germany. Its purpose is to increase local employment, support local culture, and make the local food supply more resilient.

If there is any takeaway from this COVID-19 era is that adapting to change is the only form of survival. Amidst the lockdowns and the uncertainties of currency standings and accessibility are at the forefront of the crisis. Adapting to new forms of localised and customised financial interactions is a sure way to keep the circulation going and perhaps something to think about moving into a new financial age.